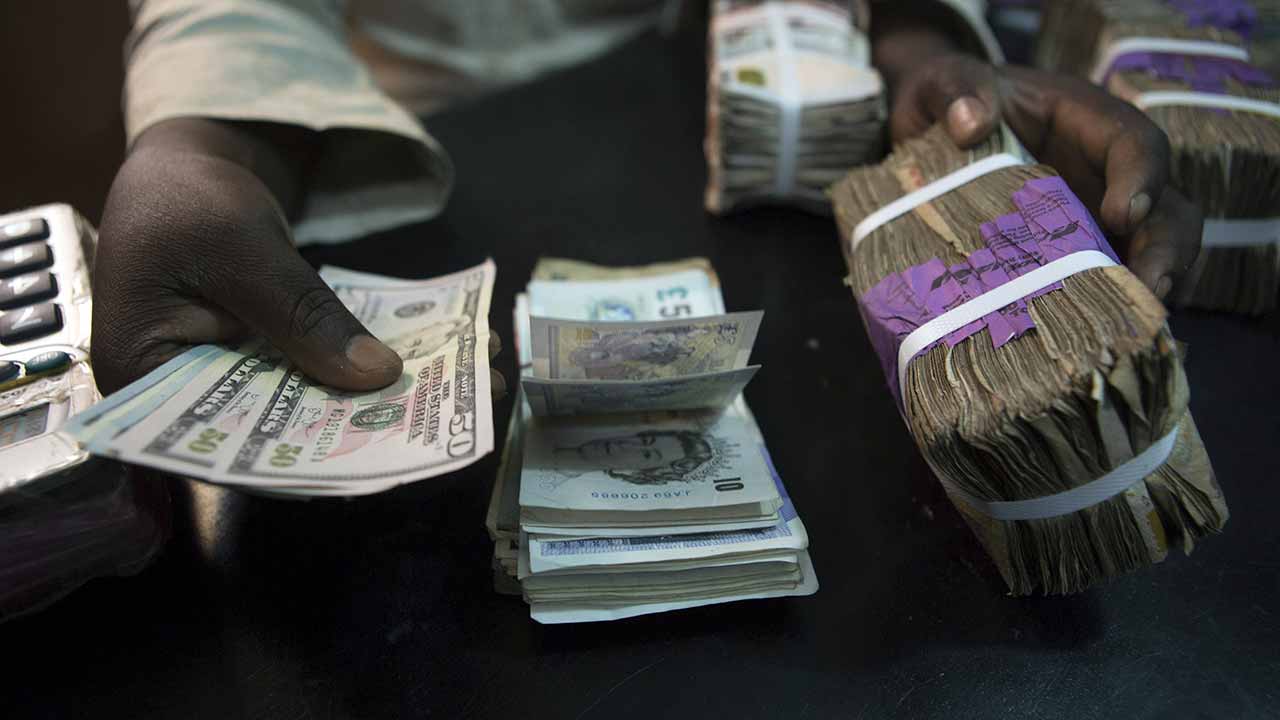

The Association of Bureaux de Change Operators of Nigeria has said that the recovery of the naira has led to a relative decrease in the prices of goods and services in the country.

The president of the association, Aminu Gwadebe, said this in a statement issued on Saturday.

He hailed the decision of the Central Bank of Nigeria to allow Bureaux de Change to operate in the foreign currency market, adding that it was a major factor in the recovery of the naira.

The CBN banned the operations of BDCs in July 2001 as part of measures to stabilise the local currency.

ABCON had been championing the campaign for BDCs to be allowed to operate formally in the currency market.

The apex bank in February reinstated BDCs in the official forex market.

In the statement, the ABCON president said aside from monetary policy tightening that led to interest rate hikes and more investment in government instruments and clearance of forex backlog forward commitments, the recall of the BDCs had significantly boosted dollar liquidity at the retail end of the forex market.

He added that with the recovery of the naira, the price of international school fees had dropped by 15 per cent; the cost of medical tourism had been reduced by 20 per cent and prices of air fares for local and international trips had dipped by 25 per cent.

Gwadabe remarked that the success story was unending as the naira traded at 1,255/$ on Saturday, lower than the 1,269.77/$ BDCs were advised to sell.

Describing the ongoing market development as revolutionary, Gwadabe declared that a stable naira would attract more foreign portfolio inflows to the economy.

He averred that the gains of the CBN under the governor, Dr Olayemi Cardoso, in recognising the power of BDCs in securing stable exchange rates cannot be over-emphasised.

He also maintained that previous practices where Nigerians based in Dubai brought dollars home for sale at high rates had ceased, after the rapid recovery of the naira against the American greenback.

Going forward, he stated that prospects for forex earnings were promising, with foreign portfolio investments on the rise and over $1.5bn inflows a few days after the Monetary Policy Committee raised the interest rate by two per cent